Chicago Real Estate Market Trends & Charts

Whether you're a first-time home buyer or investor, prior to buying any Chicago property, one of the wisest factors to initially consider is: Chicago real estate market trends and cycles. Candidly, if it's your intention to live in a property for 20-30 years, then this roller coaster becomes less scary because your strategy is long term—and timing market fluctuations is less relevant.

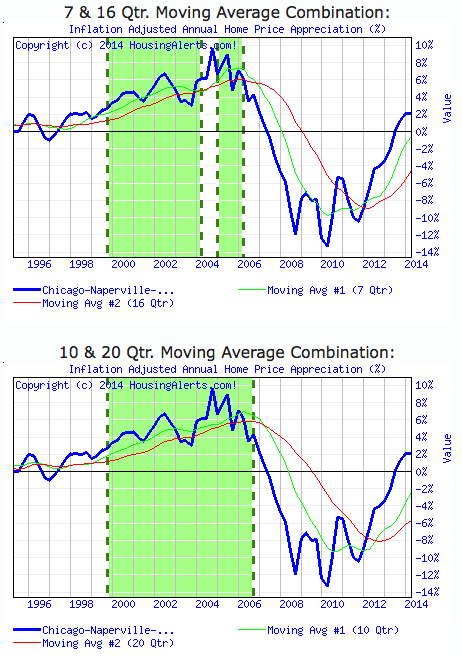

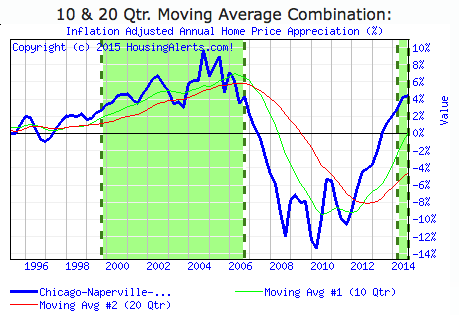

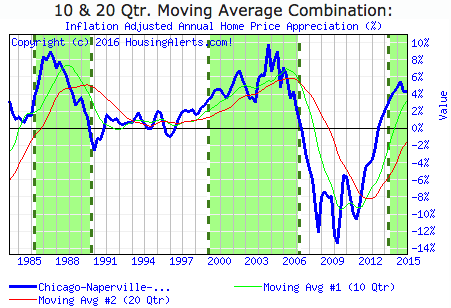

Otherwise, if you're buying any property with the intention of holding it for less than 10 years, then it's vitally important to justify these Chicago real estate market trends. One way to properly fasten your seat belt is by using technical analysis momentum indicators. Here below is a glimpse of the Chicago real estate market cycle charts courtesy of technical analysis from Housing Alerts.

Note: the long-term (red line) indicators which are of greater relevance. And the shaded green areas which indicate the wealth creation phases.

2014 - August

Notice as of August 2014 above, the dashed green lines have not yet triggered.

2014 - September

Whereas of September 2014, the Chicago technical analysis wealth triggers finally triggered after 8 long years: alerting the start of Chicago's next wealth cycle.

If you notice, Chicago's local market entered it most recent wealth phase starting in late 2014. The reason why wealth phase momentum indicators are key, is because one of the DNA traits associated with a newly emerging wealth cycle is: a local market where home prices are minimally inflating at 3% per year.

This minimum home price appreciation metric is key for anyone buying property using lender (debt!) financing—again, unless you plan on living in the property for 20-30 years. More on that in a moment. If annual home price appreciation is negative, flat or below 3% per year, then using the evil arrows of debt financing to buy a property: will undesirably unlock negative leverage.

This would be analogous to buying Google stock shares with borrowed money, when the stock is only paying you a 3% per year dividend, while your loan is costing you 4% (or more) in interest. Clearly you wouldn't borrow money from a bank to buy stock, when your cost of capital outweighs your stock's expected return. This would be an upside-down loan. So why would you do this for an asset like real estate?

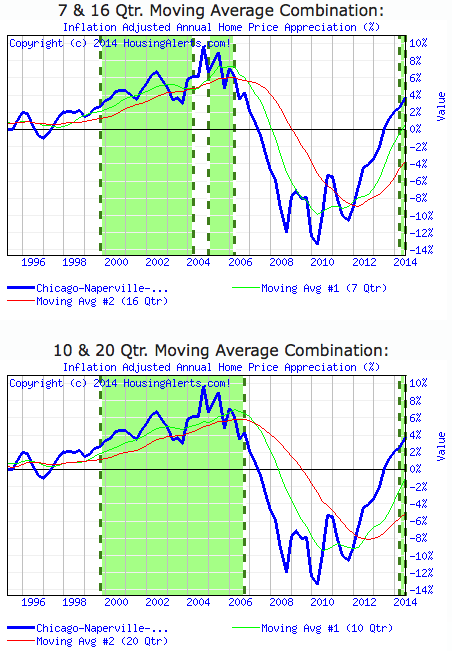

Here's a snapshot at more insider data that we monitor here at HK:

Note: snapshot as of January 26, 2016

This is not an offer to sell securities. These cycle charts do not represent buy or sell recommendations; they are for educational purposes. The information contained herein has been obtained from sources believed to be reliable. We are not registered investment advisors. Copyright 2016 by HK Creative Investments, Inc. All rights reserved.

Before we close out by showcasing the current Chicago real estate market trends, let's quickly clarify the intricacies of buying property with cash—versus buying that same property with a mortgage loan—and how the local market cycle plays a role in this decision. Listen up, because the careless banker will never tell you this subtle crux.

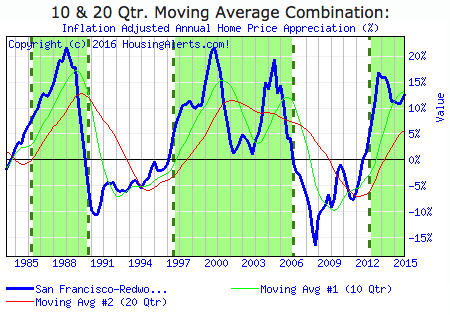

As you know, Chicago and San Francisco are both considered high momentum cyclicality markets. Take a peak at San Francisco's real estate chart here. You'll notice a couple things. For starters, San Francisco entered it latest wealth cycle in 2012—two years ahead of Chicago. Not only that, look at the magnitude of San Francisco's yearly appreciation, almost double relative to Chicago. It's plain as day: San Fran climbs into the high-teens; while Chicago tops near 10% annual market appreciation. Simply stated: San Francisco has higher peaks and valleys than Chicago.

And now for the subtle crux: how can you expect to get the same output using a national bank loan, in two markets that have two totally different potentials? In other words, if you're borrowing money to buy a property, then that bank loan will be a nationally advertised mortgage rate—say 4.2%. It's the same interest rate for the bank located in Chicago, as it is for the bank located in San Francisco.

But, as we just showed, the market potentials are not the same. So how can you expect to get the same output (bang!) for your buck, with that same loan in two different markets? Answer: you can't.

And that's the reason why you must dually justify the borrowing of money to buy any property with (1) the local market cycle and (2) how long you intend on holding or residing in the property. If you fail to do so, and you're not living in the property for three decades, then don't be surprised to find your wallet in the meat grinder, when you decide to sell seven years after-the-fact.

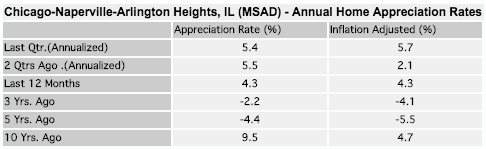

Here's a year-over-year comparison of recent Chicago real estate market trends.

2015 - February

2016 - January

Free Market Video

Get smarter faster so you can bargain shop any property within 60-minutes. Ready for free look?